Mn Tax Brackets 2025 Married Jointly. Deduct the amount of tax paid from the tax calculation to provide an example. Minnesota residents state income tax tables for married (separate) filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income.

Minnesota residents state income tax tables for married (separate) filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income. Taxpayers making quarterly payments of estimated tax should use the rate schedule to determine their payments, which are due starting in april 2025.

For tax year 2025, the state’s individual income tax brackets will change by 5.376 percent from tax year 2025.

For married couples, the standard deduction is $27,650 total if filing jointly and $13,825 (each) if filing.

Federal Bracket 2025 Clara Demetra, Calculate your total tax due using the mn tax calculator (update to include the 2025/25 tax brackets). For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples.

Understanding 2025 Tax Brackets What You Need To Know, Minnesota residents state income tax tables for married (separate) filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income. For married couples, the standard deduction is $27,650 total if filing jointly and $13,825 (each) if filing.

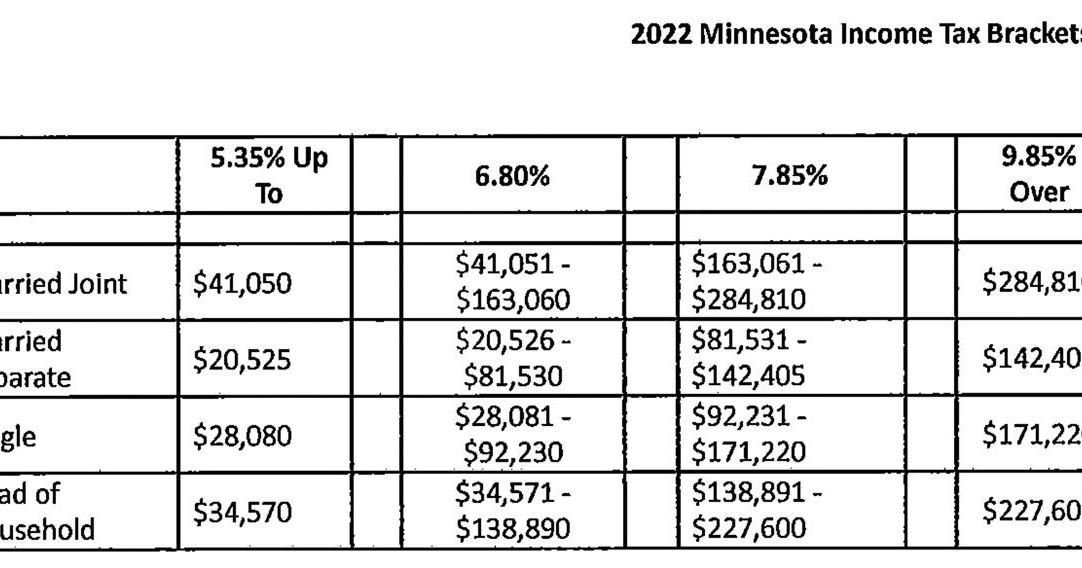

Minnesota tax brackets, standard deduction and dependent, Married couples filing their minnesota income tax return jointly will usually have wider tax brackets than. Tax rate single filers married filing jointly or qualifying surviving spouse married filing separately head of household;

2025 State Tax Brackets Latest News Update, These tables outline minnesota’s tax rates and brackets for tax year 2025. For 2025, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying.

Tax Rates Sunset in 2026 and Why That Matters Barber Financial Group, These tables outline minnesota’s tax rates and brackets for tax year 2025. (review a full list of inflation adjustments for tax year 2025.)

What tax bracket am I in? Here's how to find out Business Insider Africa, $13,825 married filing jointly or qualifying widow(er) $25,900 $25,800 $27,700 $27,650. Married couples filing their minnesota income tax return jointly will usually have wider tax brackets than.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples. The minnesota department of revenue announced the adjusted 2025 individual income tax brackets.

2025 Tax Brackets Married Filing Separately Married Filing Theda Regina, The minnesota standard deduction for the 2025 tax year (filed in 2025) is $13,825 for single filers. The adjustment does not change the minnesota tax rate that.

Irs Tax Brackets 2025 Married Jointly Latest News Update, Deduct the amount of tax paid from the tax calculation to provide an example. The 2025 tax rates and thresholds for both the minnesota state tax tables and federal tax tables are comprehensively integrated into the minnesota tax calculator for 2025.

Tax Brackets 2025 Married Jointly Norri Annmarie, Tax rate single filers married filing jointly or qualifying surviving spouse married filing separately head of household; For tax year 2025, the state’s income tax brackets will.